WARNING – What you are about to read might shock you, it might not be what you ‘expect’ to hear about Forex trading. It might even make some industry ‘gurus’ and media outlets angry, because what follows is the unfiltered, uncut truth about the Forex industry that you NEED to know before making one more trade.

If you don’t want to get chewed up and spit out by the Forex markets and the Forex industry you need to continue reading…

Online media outlets and propaganda-based information are luring ‘fresh meat’ into the trading industry. Of course, YOU are the ‘fresh meat’ but they don’t want you to know that. Basically, the Forex industry wants you to trade without an education, without knowing what you’re doing, because they know that’s the fastest way they will get your money. We’ve all heard about the ‘churn and burn’ of most Forex traders.

Don’t get me wrong, that’s not to say you can’t be successful in trading and do well, but following the ‘herd’, which is what the industry wants you to do, is certainly not going to do you any favours.

Reading this article you’re obviously interested in trading, but you’re a little more analytical than most and you want to know what’s really going on ‘behind the scenes’, if you will. You want to understand how to start your journey and how you should progress in trading. Today’s article is going to dispel some common myths and misconceptions about the Forex industry and will equip you with the knowledge you need to make wise decisions and find the path to trading success…

Note: If you’re an absolute beginner and this is literally the first article you’ve read on trading, then stop right here and do yourself a favour and take my beginners course, because if you have no clue what’s going on, you need to get a clue to understand the basics or to understand any post on this blog.

The reality of how the Forex trading industry works

Here’s the straight-out version of Forex that you’re not gonna hear or see anywhere else…

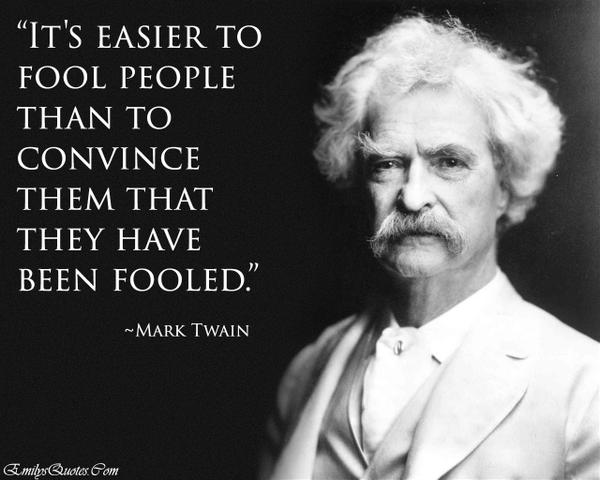

You probably don’t know it, but you’ve been lured in by the Forex ‘machine’. There is a whole industry designed to hook new traders by only focusing on the positive aspects of Forex trading and ‘all the money you can make’. It’s sad, but true.

Here’s the truth: Blogs, forums, and various media outlets about trading all create hype and either directly or indirectly mislead traders as to the risks and rewards possible in Forex trading. Essentially, they are leading you to the ‘slaughter house’, which is the Forex market. The market and most brokers don’t care at all if you lose. You can get chopped up and minced into tiny pieces and they are still going to make money. When you trade with your broker, they’re going to make money whether you win or lose, which you may not have known. It’s an industry full of brokers who want as many clients to trade as much as possible. They don’t really care if you’re educated or not, or even if you don’t have a bloody clue about what’s going on.

Oh, and the less educated you are about trading and how to trade, the more money you are probably going to gamble away in the market, which is what they want. So, if you try trading a live account with no formal trading education, it’s equivalent to you walking through a minefield without knowing where the mines are.

Many of these media outlets, blogs, forum-based sites and brokers work together, leading new and unaware traders down the path to the ‘slaughterhouse’. Each of them may try to pick your pocket along the way; whether it’s getting you to pay for some ‘premium’ news alert service or ‘pit noise’ service or charging you $5,000 for some ‘in-depth’ training, they will get you one way or the other. That’s not to say no one should charge money for trading education, but everything should be within reason. There’s no reason why anyone should charge thousands of dollars for a trading course or try go get you to pay a high monthly fee to some signal subscription service when they could simply teach you how to trade and spot the signals for yourself, for a small one-time fee. There’s a difference between helping people learn to trade for a low reasonable one-time fee, and taking advantage of them for thousands of dollars.

Pull your head out of the clouds and be realistic

So, if you have big hopes and expectations about Forex trading, I am not really here to shoot them down, I’m just trying to bring you down to the ground and instil realistic expectations in you. After all, when our expectations don’t mesh with reality, that’s when we experience emotional pain.

So, if you have big hopes and expectations about Forex trading, I am not really here to shoot them down, I’m just trying to bring you down to the ground and instil realistic expectations in you. After all, when our expectations don’t mesh with reality, that’s when we experience emotional pain.

You’ve probably already had the misfortune of coming across websites selling automated trading software that promises sky-high returns by simply purchasing and installing their software. They often show a nice looking track record of XYZ pips that their ‘system’ has returned over XYZ years. Well, guess what? These things can easily be photo-shopped. I believe it was Edgar Allen Poe who said, “Don’t believe anything you hear and half of what you see.” If it sounds too good to be true, it probably is.

Even the education industry is too full of positivity. They’re not really talking about the risks and pitfalls of trading as much as they are about the potential rewards and lifestyle of a rich trader.

Don’t’ believe it, don’t believe people if all they talk about is the positivity but little to nothing about the risks. Don’t believe people that just flash the trader lifestyle and how much money you can make without providing a grounded foundation of the risks and rewards. Remember, they want you to have a false-view of what trading is all about so that you give them your money and give your broker money and start trading away.

False-confidence when you’re still naïve

Once of the big problems for beginning traders is having false-confidence when you are still new and naïve. I can’t even tell you how many emails I get from traders telling me they didn’t use a stop loss and lost half their account or more. Forex is a shorter-term game than say investing in stocks, so you have to set risk parameters to avoid large losses, you can’t expect to enter a trade and hold it forever with 1:100 leverage and never lose money.

But, again, the Forex industry preys on things like this. They know beginning traders will have false-confidence after a couple winners and then give back all their profits and then some.

Don’t try convincing yourself that you actually ‘know’ something about a market ‘for sure’. I’ve got news for you, it took me five years before I really started to make this work. So, whatever you do, don’t get too cocky too soon or you will give all your money to the Forex ‘machine’.

Having false-confidence leads traders to do crazy things like risking half their account on the ‘next big trade’ without using a stop loss. This type of behaviour is also caused by not having proper education or the proper mental foundation.

Many people think that because they were or are very successful in other professions that it will translate over to trading. But that’s often not the case as I have discussed in other articles. Just because you succeed in one part of life doesn’t mean you will in trading right away, so don’t make the mistake of getting overly-confident just because you are very successful lawyer, doctor or anything else. Trading, like any other profession, has a learning curve.

Ego vs. Insanity

Maybe you’re an experienced trader and maybe you’ve already been trading 2 to 5 year or more, but you’re still struggling. If this is you, it’s important that you realize you might be suffering some sort of trading addiction and you don’t even know it. Do you do the same thing over and over in the market and continue to lose yet you aren’t changing anything about yourself or your strategy?

Someone who is too arrogant to change will never become a successful trader. They’d rather just keep doing what they’re doing, losing money, because they feel ‘safe’ and comfortable not admitting they need to change and making an effort to do so.

Are you potentially addicted to trading? Too proud that you might have to change you’re strategy or how you’re managing your money?

Failure to address problems like this and look for solutions is a big reason many traders fail. Trading is really an on-going game of trial and error. You will never stop learning and you will never stop growing as a trader, at least you should never stop. If you find yourself doing the same things and making the same mistakes over and over, take it as a sign that what you’re doing isn’t working and you need to change.

Some of these on-going problems that traders have are things like strategy-jumping (where you jump from one strategy to the next at the first sign of a loss), risking irregular amounts per trade, trading for pleasure instead of profit, having a gamblers attitude / trading for the adrenaline rush.

Also, you need to consider that if you’ve been doing this for say, 5 years and losing money, maybe it’s time to hang up the boots…maybe trading isn’t for you?

So are you gonna be another number in the losers column or are you gonna stop what you’re doing and have the balls to change?

Don’t be fooled by the ‘next big thing’, you’ll only be disappointed.

It’s clear after being in the industry across two decades now and knowing many traders from professional to part-time / hobbyists, that whilst trading can be mastered and there’s lots of money to be made, there’s obviously lots of money to be lost if you don’t know what you’re doing and don’t have your strategy and money management down-pat yet.

It’s clear after being in the industry across two decades now and knowing many traders from professional to part-time / hobbyists, that whilst trading can be mastered and there’s lots of money to be made, there’s obviously lots of money to be lost if you don’t know what you’re doing and don’t have your strategy and money management down-pat yet.

Just be careful, because its only human and very natural to keep looking for something else that ‘might work’ if what you’re doing isn’t working. I’m here to assure you that there is no ‘next big thing’, no system, strategy or ‘holy grail’ to make you rich in the markets.

The way that I personally trade and approach the markets is based on simplicity and logic and the ability to accurately read a chart, because if you can’t read a chart from left to right and actually understand and interpret it, it doesn’t matter how good your system is or what the ‘next big strategy’ is, you’re never gonna make it.

By now you probably know I trade price action, I trade off charts, after all my years in the market, this is what I’ve fallen back on because there’s nothing more certain than first hand-data, i.e. the price action we’re interpreting the market through and finding trades from.

Would you drive a car going forward while looking in your rear view mirror? No, you wouldn’t. Well, that’s pretty much what everything else is out there other than price action. If you cannot feel, read and interpret a chart, you‘re not gonna stand a chance. Remember, the greatest traders who have ever lived have been able to read these markets via price action.

The bottom line is this: You NEED a trading education before you start trading live. If you’re a complete beginner at least do a beginners course so you have a clue. Then, consider an advanced trading course such as the one I offer here, regardless, just get yourself an education so you have an idea of what’s actually happening before you start trading.

0 comments:

Post a Comment